Use the link below to make a loan payment with a debit card. To pay from a bank account, please register for digital banking.

Home Equity Loans & Lines

Home Equity Loans & Lines

Home equity is basically the difference between how much your home is currently worth and how much you owe on your mortgage. With a home equity line of credit (HELOC) or a home equity loan, you can use the equity in your home as collateral to borrow money.

Home Equity Line of Credit Special - Ends September 30, 2025

Intro rate

as low as

5.24%

Variable

APR1

Then,

as low as

7.50%

Variable

APR1

What’s a home equity line of credit (HELOC)?

A HELOC is a line of credit that uses the equity in your home as collateral. With a HELOC, you’re approved for a certain amount and can pull from your line of credit whenever you need money.

Flex Home Equity Line of Credit

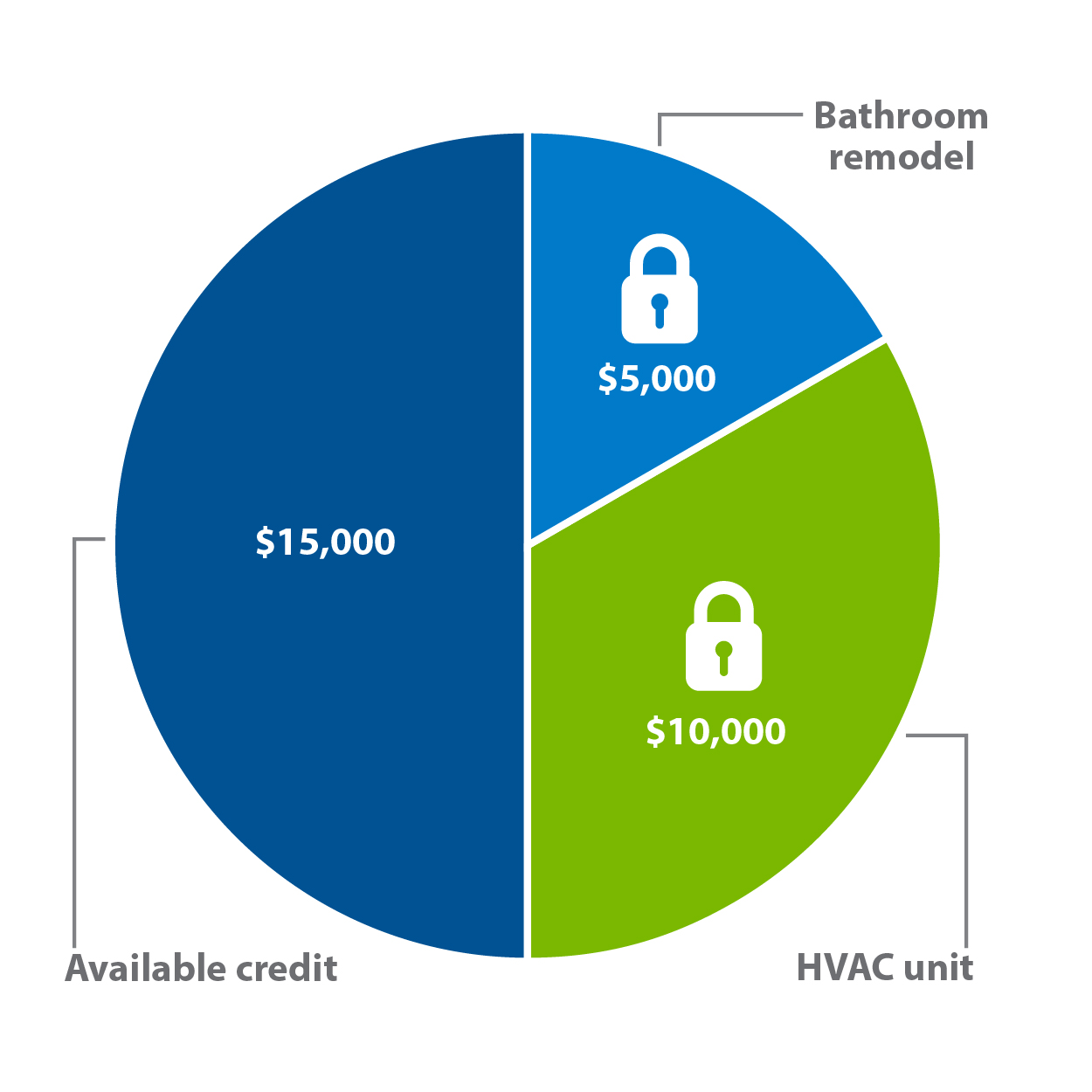

With a Flex HELOC, you can combine the flexibility of a line of credit with the peace of mind of a fixed loan! This line of credit lets you lock down a portion of your balance with a fixed rate and set monthly payment. You can have up to five active rate locks at a time.

How it works

Once you get a Flex HELOC, you’ll be able to transfer money from the line whenever you need it. The line will open for 10 years, known as the draw period, with a variable interest rate. After the draw period, you’ll have another 10-year period for repayment.

Rate locks

Variable rates can lead to uncertainty. That’s why we let you lock down a portion of your Flex HELOC’s balance! Once you’ve locked a portion of the balance, that segment will have a fixed rate and fixed payment for the length of the lock period.

- You’ll have flexible term options up to 15 years. Please note the term can’t exceed your HELOC’s maturity date.

- As you make payments toward the principal balance of your locked segment(s), the available balance on your HELOC will increase.

- You can have up to five rate locks on your Flex HELOC.

- There’s a $5,000 minimum for each rate lock segment.

- There’s a $75 service charge to set up a rate lock, which is added to the balance.

What’s a home equity loan?

A home equity loan functions more like a traditional mortgage. It’s a fixed, lump sum loan that uses the equity in your home as collateral. With a home equity loan, you receive a set amount of money to use.

These loans have a fixed rate with a few term options. After closing, the total amount will be deposited directly into your account, and you’ll have a set monthly payment.

Use our HELOC Calculator to see which term may work best for you!

Not sure which option is right for you? We can help!

A HELOC might be right for you if:

· You want a line of credit to use for unexpected expenses.

· You have an ongoing expense, such as a home renovation.

ApplyA home equity loan might be right for you if:

· You need an exact amount of money for a large one-time purchase.

· You want a predictable monthly payment for a set term.

ApplyFast track your refinance with Centra’s Flex Home Equity Line of Credit!

Quickly and easily refinance your home equity line of credit (HELOC)3 with Centra! A refinance of your HELOC is beneficial if you’re:

- Nearing the end of the draw period on your existing HELOC

- Nearing the maturity date of your HELOC

- Looking to lower your payments

- Looking for flexible term options

Refinancing with Centra’s Flex HELOC is quick and easy! Plus, you could take advantage of options like a great low intro rate or up to $800 in closing costs covered by Centra!

Apply for a home equity loan or line of credit today!

Centra will pay your closing costs, up to $800!2

Open a checking or savings account today!

Centra is built differently, and it’s what our Members experience every day.

Become a MemberApply for a Loan

From a new home to a new car, and anything in between, we’ve got you covered.

View LoansAn appraisal may be required for a home equity loan or line of credit. Closing costs can be rolled into the balance of the loan. Home equity products have no prepayment penalties or early payoff fees from Centra. When the loan is paid in full and closed, a service charge may be assessed by the county to release the lien on the property.

1. APR= Annual Percentage Rate and is based on a variable loan product. All loans are subject to credit approval. The introductory promotional 5.24% APR will be in effect for the first six months from the time you close the loan. After the first six months, the APR will adjust to our standard rate. The APR is based on the Prime Rate (index) plus a margin of Prime Plus 0.00% to 2.00% (currently 7.50% – 9.50%). We will use the most recent index available to us as of 10 business days prior to the month-end before the date of any APR adjustment. The rate is subject to change the first of each month to reflect any change in the index. The maximum APR that can apply is 18.00% and the minimum that can apply is 7.50%. The minimum line amount is $10,000. This offer is only good for new loans to Centra on owner-occupied residential properties. All loans must be closed by October 15, 2025. Homeowners insurance is required. Consult your tax advisor about deductibility of interest. Closing costs will range from $150 to $800. Up to $800 of closing costs will be paid by Centra. If the line is paid off and closed within the first 36 months, closing costs must be repaid. If Centra pays a portion of closing costs on a home equity loan or line of credit, the rate margin will increase by 0.40%. Fixed-term and fixed-rate home equity loans are also available. Offer subject to change without notice.

2. Reimbursement of the closing costs is required if the line of credit is closed before 36 months or the home equity loan is paid off before 36 months. If Centra pays a portion of closing costs, up to $800, on a home equity loan or line of credit, the rate margin will increase by 0.40%.

3. Refinanced lines of credit must be a new loan to Centra OR an existing HELOC with Centra that is within six months of either the draw period end date or loan maturity date.