Budgeting for Goals: A New (Or New to You) Car

Before you buy, prioritize. Cars can eat up a lot of your income. If a new car isn’t important to you, consider buying an inexpensive older model that you won’t have to finance.

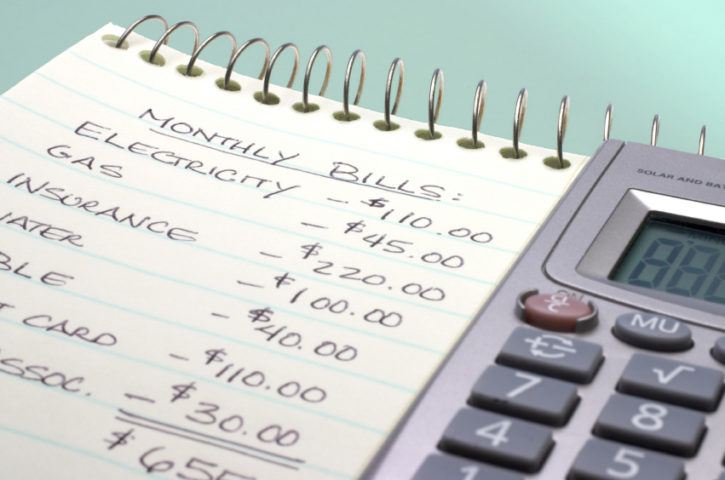

If a new car is important to you, make sure you know what your expenses will be. Budgeting for cars is a two-part system. First you have to save for a down payment. Then you have to adjust your monthly budget to accommodate a loan payment. If you‘re not already a car owner, you’ll have to take into account gas, insurance, maintenance and repairs too.

Down Payment: If you need a vehicle right away, you can usually finance the entire cost of a new vehicle. But keep in mind, your monthly payment will be higher if you don’t make a down payment. If you’re trading in a vehicle, this also lowers your monthly payment. Other upfront costs include taxes, title, and license fees.

Monthly payment: A new vehicle is a big purchase. Make sure you can afford it. Research the vehicles you’re interested in to see what they may cost. If the car you want doesn’t fit in your budget, consider buying it used. Used vehicles tend to be less expensive, but sometimes still have the manufacturer’s warranty.

After you buy your car, tweak your budget. If your new car gets better gas mileage, you can lower your fuel budget. Insurance on a new car will likely be more expensive.